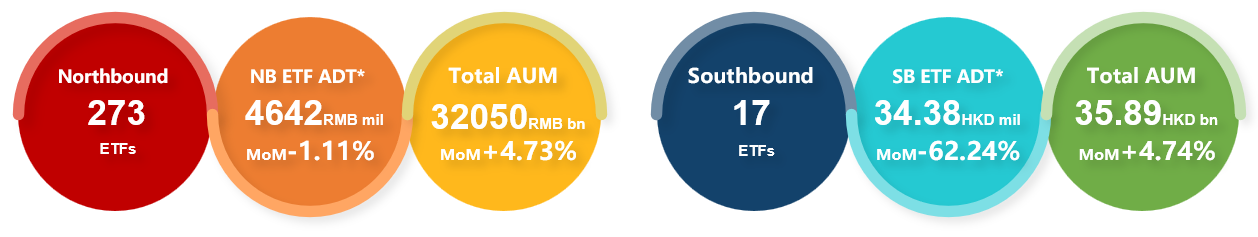

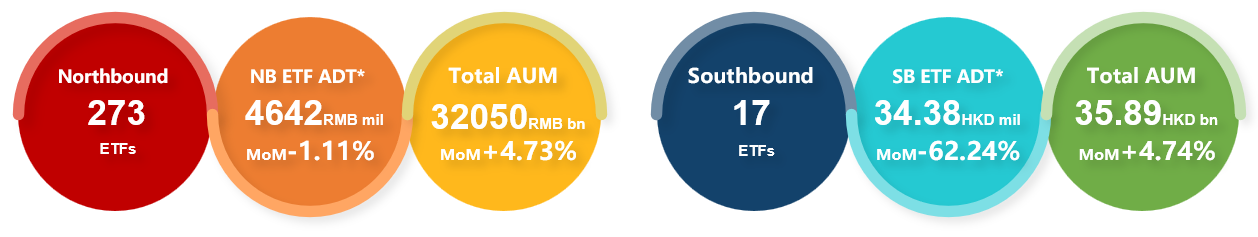

September Overview

Source: SSE, SZSE, HKEX, CESC. Data cut-off date: 30 Sep 2025.

*SouthBound/Northbound ETF ADT: ADT under Stock Connect.

Top 10 Northbound ETFs of Sep

| TOP 10 ETFs by AUM |

| Rank |

Code |

Name |

AUM

(RMB mil) |

| 1 |

510300 |

Huatai-PB CSI 300 ETF |

425,577.23 |

| 2 |

510310 |

E Fund CSI 300 ETF Initiating Fund |

304,795.51 |

| 3 |

510330 |

ChinaAMC CSI 300 ETF |

228,061.13 |

| 4 |

159919 |

Harvest SZSE SME-CHINEXT 300 ETF |

199,693.71 |

| 5 |

510050 |

ChinaAMC China 50 ETF |

180,456.67 |

| 6 |

510500 |

China Southern CSI 500 ETF |

140,099.02 |

| 7 |

159915 |

E Fund Chinext ETF |

110,184.22 |

| 8 |

588080 |

E Fund China Science And Technology Innovation Board 50 Component ETF |

76,760.22 |

| 9 |

512100 |

China Southern CSI 1000 ETF |

76,630.74 |

| 10 |

588000 |

ChinaAMC China Science And Technology Innovation Board 50 Component ETF |

75,620.56 |

| TOP10 ETFs by Monthly Return |

| Rank |

Code |

Name |

Return

(1Month) |

| 1 |

561160 |

Fullgoal CSI Battery Thematic ETF |

40.00% |

| 2 |

561910 |

China Merchants CSI Battery Thematic ETF |

39.23% |

| 3 |

159796 |

China Universal CSI Battery Thematic ETF |

38.93% |

| 4 |

159755 |

GF CNI New Energy Vehicle Battery ETF |

31.60% |

| 5 |

159840 |

ICBCCS Guozheng New Energy Vehicle Battery ETF |

31.32% |

| 6 |

515030 |

Hua Xia CSI New Energy Vehicles ETF |

27.48% |

| 7 |

159806 |

Guotai CSI New Energy Vehicles ETF |

27.26% |

| 8 |

515700 |

Ping An CSI New Energy Vehicles Industry ETF |

26.75% |

| 9 |

159637 |

Tibet Dongcai CSI New Energy Vehicles ETF |

26.07% |

| 10 |

159558 |

E Fund CSI Semiconductor Material Equipment Theme ETF |

25.48% |

| TOP 10 ETFs by Monthly Net-Buy |

| Rank |

Code |

Name |

Net Buy**

(RMB mil) |

| 1 |

512880 |

Guotai CSI All Share Investment Banking & Brokerage Index ETF |

11,680.97 |

| 2 |

159755 |

GF CNI New Energy Vehicle Battery ETF |

7,239.77 |

| 3 |

159530 |

E Fund CNI Robot Industry ETF |

6,468.94 |

| 4 |

512000 |

Hwabao WP CSI All Share Investment Banking & Brokerage Index ETF |

6,185.71 |

| 5 |

159796 |

China Universal CSI Battery Thematic ETF |

5,572.27 |

| 6 |

517520 |

Maxwealth CSI Shanghai-Shenzhen-Hong Kong Gold Industry Commodity ETF |

4,708.97 |

| 7 |

159870 |

Penghua CSI Subdivision Chemical Industry Theme ETF |

4,529.26 |

| 8 |

562500 |

ChinaAMC CSI Robot ETF |

4,485.01 |

| 9 |

512400 |

China Southern CSI SWS Non-Ferrous Metal ETF |

4,091.03 |

| 10 |

159516 |

Guotai CSI Semiconductor Material Equipment Theme ETF |

3,977.39 |

| TOP 10 ETFs by Monthly ADT |

| Rank |

Code |

Name |

ADT***

(RMB mil) |

| 1 |

159915 |

E Fund Chinext ETF |

6,320.25 |

| 2 |

588000 |

ChinaAMC China Science And Technology Innovation Board 50 Component ETF |

6,022.94 |

| 3 |

588200 |

Harvest SSE STAR Chip Index ETF |

4,238.87 |

| 4 |

510300 |

Huatai-PB CSI 300 ETF |

4,206.30 |

| 5 |

512880 |

Guotai CSI All Share Investment Banking & Brokerage Index ETF |

3,796.98 |

| 6 |

159949 |

Huaan SZSE Chinext 50 ETF |

3,176.61 |

| 7 |

510050 |

ChinaAMC China 50 ETF |

2,512.79 |

| 8 |

515880 |

Guotai CSI All Share Communication Equipment ETF |

2,236.73 |

| 9 |

562500 |

ChinaAMC CSI Robot ETF |

2,038.66 |

| 10 |

512480 |

CPIC CSI All Share Semiconductors & Semiconductor Equipment ETF |

2,007.07 |

Southbound Eligible ETFs Overview

| Code |

Name |

Tracking Index |

AUM

(HKD mil) |

1M Return |

Net Buy**

(HKD mil, 1M) |

ADT***

(HKD mil, 1M) |

| 2800 |

TRACKER FUND OF HONG KONG |

Hang Seng Index |

161,780.35 |

7.46% |

-6,069.48 |

16,319.35 |

| 2828 |

HANG SENG CHINA ENTERPRISES INDEX ETF |

Hang Seng China Enterprises Index |

29,453.78 |

7.20% |

-8,789.05 |

10,102.35 |

| 3033 |

CSOP HANG SENG TECH INDEX ETF |

Hang Seng TECH Index |

74,071.73 |

13.84% |

2,544.50 |

9,584.20 |

| 3067 |

ISHARES HANG SENG TECH ETF |

Hang Seng TECH Index |

29,448.10 |

13.94% |

98.23 |

414.44 |

| 3037 |

CSOP HSI ETF |

Hang Seng Index |

931.09 |

7.58% |

-240.49 |

1.63 |

| 3032 |

HSTECH ETF |

Hang Seng TECH Index |

6,877.61 |

13.86% |

-94.21 |

216.87 |

| 2837 |

GX HS TECH |

Hang Seng TECH Index |

1,732.97 |

13.90% |

0.00 |

6.19 |

| 3088 |

CAM HS TECH |

Hang Seng TECH Index |

2,022.07 |

13.88% |

52.03 |

59.39 |

| 3110 |

GX HS HIGH DIV |

Hang Seng High Dividend Yield Index |

3,638.83 |

0.67% |

-20.14 |

33.49 |

| 3403 |

CAM HSI ESG |

HSI ESG Enhanced Index |

10,967.09 |

6.82% |

933.70 |

38.28 |

| 2801 |

ISHARES CHINA |

MSCI CHINA |

25,573.50 |

9.50% |

-880.67 |

7.79 |

| 2825 |

WISECSIHK100ETF |

CSI HK 100 |

2,735.86 |

9.36% |

1.84 |

0.02 |

| 3040 |

GX MSCI CHINA |

MSCI CHINA |

1,830.61 |

9.49% |

-51.33 |

7.12 |

| 3069 |

CAM HSBIOTECH |

Hang Seng Hong Kong-Listed Biotech |

1,458.24 |

5.46% |

109.38 |

64.24 |

| 3070 |

PING AN HKDIV |

CSI HK Dividend |

3,351.67 |

-0.85% |

-1,117.99 |

7.95 |

| 3115 |

ISHARESHSI |

Hang Seng Index |

2,352.27 |

7.60% |

32.91 |

5.82 |

| 3039 |

EFUNDHSIESG |

HSI ESG Enhanced Index |

699.73 |

6.83% |

0.00 |

1.81 |

Source: SSE, SZSE, HKEX, CESC. Data cut-off date: 30 Sep 2025.

**Net-Buy(estimated)= Σ(Fund units Increment × Daily Turnover / Daily Volume)

***ADT: ADT in home market

DATABASE

More Info of ETFs' Issuers

Guotai Fund is one of the first fund management company established in China. As of July 22, 2022, there were 41 non-currency ETFs in Guotai Fund, with a total scale of 98.478 billion yuan.

Huaan Funds Management Company was founded in 1998. At the end of 2021, the total AUM of Huaan is nearly 600 Billion CNY.

China Asset Management Company (ChinaAMC) was founded in 1998. By the end of 2021 it managed 58 ETF with a combined asset under management of RMB 245.7 billion.

China Southern Asset Management Co., Ltd. was founded on March 6. As of June 30 2022, SAM managed 296 mutual funds worth RMB 1050.2 billion.

Penghua Fund was established in 1998, As of June 30, 2022, the company has managed 267 public funds with a total scale of 929.2 billion. A total of 22 ETFs were managed, with a total scale of 24.2 billion.

Harvest Fund was established in March, 1999. As of June 2022, the company has managed 275 public funds with a total scale of 781.623 billion. A total of 32 ETFs were managed, with a total scale of 36.258 billion.

Fullgoal Fund Management Co Ltd was founded in 1999. As of 30 June, 2022, Fullgoal Fund has a total mutual fund AUM CNY 647 billion (excluding MMF and short-term wealth management bond funds).

Yinhua Fund was established in May 2001. By the end of 2023, there are 40 ETFs under management, with a total AUM over RMB 130 billion.

China Merchants Fund Management Co., Ltd. was established in 2002. As of December 31, 2022, the non-monetary fund assets under management of China Merchants Fund was more than 560 billion yuan, ranking No.5 in the industry at first time.

Hwabao WP Fund Management Co., Ltd. established on March 7, 2003. As of Dec 31th, 2023, the company's assets under management reached over 320 billion yuan, with 138 open-end funds under management.

GF Fund Management Co., Ltd. established on August 5, 2003. As of Dec 31th, 2021, the company's assets under management reached over a trillion, with 295 open-end funds under management.

Tianhong Asset Management was established in 2004. As of June 30, 2022, 160 public funds had been managed,which the scale of public fund management is up to 1196.90 billion yuan.

Huatai-PineBridge Fund Management Co., Ltd (“Huatai-PineBridge” or “HTPB”) was Established in 2004. HTPB’s ETFs have combined assets under management of over US $16 billion (as of 31 Dec 2021).

China Universal Asset Management Co., Ltd. ("CUAM") was established in 2005 and is headquartered in Shanghai. As of the end of the second quarter of 2022, CUAM has managed 252 mutual funds in China.

IMPORTANT NOTICE

IMPORTANT RISK WARNINGS / NOTES Information provided on this webpage of Stock Connect ETF Information Portal (the “Webpage”) is for general information and reference only. None of the information contained on the Webpage constitutes nor is intended to be construed as an advertisement or investment advice or an offer, solicitation, or recommendation to deal in any securities or investments in any jurisdiction and does not purport to represent or warrant the outcome of any investment strategy, program or product.

The Webpage is not directed at, and is not intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject China Exchanges Services Company Limited (“CESC”), Hong Kong Exchanges and Clearing Limited, Shanghai Stock Exchange and Shenzhen Stock Exchange (together, the “Entities”, each an “Entity”) to any registration requirement within such jurisdiction or country. No content in the Webpage may be regarded as creating any obligation on the part of any of the Entities.

CESC does not provide investment, legal, tax or other advice through any information and nothing herein should be construed as being investment, legal, tax or other advice. CESC does not represent that any investment instruments or services discussed are suitable for any investor.

Investors should note that all investments involve risks including the possibility of loss of the capital invested. Prices of investment products may go up as well as down and may even become valueless, and past performance information presented is not indicative of future performance. Investors should not base on the information to make any investment decision, but should read in detail the offering documents and terms and conditions (including the full text of the risk factors stated therein) of the relevant investment products, and should seek the advice of a professional financial advisor when making a decision about investments.

DISCLAIMERAll information contained in this website and any pages (the “Website”) thereof (the “Information”) is provided for reference only. The information is provided by China Exchanges Services Company Limited (“CESC”) for general information and reference only. CESC endeavours to ensure the accuracy and reliability of the Information but makes no warranty or representation as to its accuracy, completeness, reliability or suitability for any particular purpose. CESC accepts no liability (whether in tort or contract or otherwise) whatsoever to any person for any loss or damage arising from any inaccuracy or omission in the Information and/or from any decision, action or non-action based or in reliance upon the Information. None of the Information is intended to constitute investment advice and/or a recommendation to make (or refrain from making) any kind of investment decision. Any person intending to use the Information and/or any part thereof should seek independent professional advice. The Information is provided without warranties of any kind, either expressed or implied, including (but not limited to) warranties of merchantability, merchantable quality, title, fitness for a particular purpose, security and non-infringement.

Hong Kong Exchanges and Clearing Limited, Shanghai Stock Exchange and Shenzhen Stock Exchange do not guarantee the accuracy and reliability of the Information and accepts no liability (whether in tort or in contract or otherwise) for any loss or damage suffered by any person arising from any inaccuracies or omissions and/or for any reliance placed on such Information.

CESC neither endorses nor is responsible for the accuracy or reliability of the information produced and provided by third-party information providers on this webpage of ETF Connect Information Portal (the “Webpage”), and under no circumstances will CESC be liable for any loss or damage caused by any opinion or statement made in the Webpage. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments mentioned herein. Any projections and opinions expressed herein are expressed solely as general market commentary and do not constitute solicitation, recommendation, investment advice, or guaranteed return. The opinions expressed are those of the featured speaker(s), and do not represent CESC's views. The opinions given by the featured speaker(s) are subject to changes without notice and should not be construed as a solicitation, recommendation, or advice on any individual holdings or market sectors. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any third party information, projections and/or opinions provided on the Webpage and the basis upon which any such third party projections and/or opinions have been made, and no liability or responsibility is accepted by CESC in relation to the use of on any such third party information, projections and/or opinions whatsoever provided on the Webpage. Investors must make their own assessment of the relevance, accuracy and adequacy of the information, projections and/or opinions provided on the Webpage and make such independent research/investigations as they may consider necessary or appropriate for the purpose of such assessment. CESC does not make any representation, solicitation, recommendation, or assessment as to whether or not any of the information mentioned herein is/are suitable or applicable to any persons and thus shall not be held responsible in this regard. Investors should make investment decision(s) based on his/her own financial situation, investment experience, investment objectives, and specific needs; and if necessary, should seek independent professional advice before making any investment decision(s).

LINKED WEBSITESThe Webpage may contain links to other websites which are not operated by CESC. These links have been provided solely for you to obtain further information about other relevant entities in the market. CESC have no control over the information referred to on these sites or the products or services on them, and therefore makes no representations and accepts no responsibility regarding the accuracy or suitability of the information, services or products described on them. You are advised to make your own enquiries in relation to third parties described or linked on this internet site. Inclusion of a link to a third party site should not be construed as an endorsement of such third party site by CESC or that party's endorsement of the Website.

By linking to sites not operated by CESC, CESC is not authorizing the reproduction of any material on such sites, as such material may be the subject of third party intellectual property rights.

DOWNLOADS AND E-MAILThe Webpage allows for downloading of files. CESC does not accept liability for any loss or damage which may result from the downloading or e-mailing of any of these files. E-mail is not secure and can be intercepted, corrupted or amended. CESC does not accept liability for errors or omissions arising as a result of interrupted or defective transmission.

COPYRIGHT NOTICEOn the premise of complying with relevant laws and this statement, any institution or individual may browse and download the content of the Website for non-commercial purposes, but distribution, redistribution, reproduction, modification, transmission, use, reuse and/or storage of the Information in whole or in part, in any form or by any means are strictly prohibited without the prior written permission of CESC.